Pair Trading Strategy: A Comprehensive Guide

TradingView is a robust trading platform that has revolutionised the online trading and investment landscape. In this article, we’re going to take a closer look at what the platform is all about, how it works, and the various advantages it offers to traders and investors across the globe. It doesn’t matter if you’re an experienced trader or a newcomer to financial markets; getting to grips with this platform could improve your approach to trading, deepen your understanding of the markets, and possibly lead to greater success. Stay with us as we dive into the details of this versatile platform.

The history of TradingView

TradingView was founded in 2011 by Stan Bokov, Denis Globa, and Constantin Ivanov, with the aim of allowing traders to analyze, discuss and trade global markets. The founders, who also developed MultiCharts (desktop software tailored for the discerning needs of professional traders), wanted to transition their expertise into a web-based platform accessible to a wider audience. They didn’t stop at creating comprehensive trading software; they infused it with social features to encourage interaction and shared learning among users.

Imagine a community where an early user like TimWest, starting with only 196 followers, could grow a following of over 56,000 dedicated traders. That’s the community TradingView nurtured from its beta release in September 2011. Gaining rapid popularity, the platform caught a significant break in 2013 by joining the Chicago TechStars accelerator program, securing seed funding to flesh out its staff and enhance its offerings.

With significant investment boosts throughout the years, the platform has continuously scaled up to meet global demands. In its pursuit of innovation, December 2020 saw the launch of Timelines, linking the history of public companies to their market share prices and Streams, offering real-time analysis sharing among users.

What is TradingView now?

TradingView is now widely recognized as one of the leading trading platforms. With offices in both New York and London, the platform is a global hub for financial discussion and analysis, and a top-tier tool for those interested in the stock, forex, cryptocurrency, and futures markets. It equips users with sophisticated online charting tools, up-to-the-minute market data. Far more than just a platform for market analysis, TradingView also doubles as a social network that is continually shaped and informed by an ever-growing, vibrant community of traders.

Here, individuals freely share trading tips and strategies, benefiting from the seasoned expertise of advanced traders. This community element is key to unraveling the complexities of trading for newcomers and fosters a culture of learning and collaboration.

The platform’s “Paper Trading” feature also lets users simulate trading to hone their strategies without any financial risk. Serving millions, from solo retail investors to hefty institutions, the platform is an indispensable ally for anyone engaged in the financial markets.

TradingView Features

Building on its reputation as a versatile platform, TradingView extends beyond market insights and community forums; it’s also rich with user-friendly features for visualizing financial information, designed to support anyone involved in the financial markets. Let’s take a closer look at some of its key features.

Technical Analysis

At the heart of TradingView’s technical analysis offerings are its trading indicators, a core suite of tools that cater to different trading styles and allow for a detailed examination of market behavior and the analysis of historical price movements. With its array of indicators and chart patterns, users can make more informed decisions about where the markets may be heading next. Its intuitive interface provides many chart options like candlesticks, bars, and line graphs.

Whether one prefers straightforward tools like moving averages or opts for more intricate methods like the Elliott Wave Theory, TradingView has something for everyone.

Trading Indicators

Diving deeper into the platform, there are a variety of sophisticated trading indicators, which include the likes of Moving Averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands, which provide users with straightforward means to gauge market behavior and make predictions.

Here's a brief on how they work:

- Moving Averages help in smoothing out price fluctuations.

- RSI is great for spotting overbought or oversold conditions.

- MACD can signal potential buys or sells.

- Bollinger Bands assist in identifying if prices are relatively high or low.

The platform’s real strength comes from its active community and the use of Pine Script™ , a programming language for creating custom trading indicators and strategies. This straightforward language has led to the creation of a large collection of Community Scripts. These scripts, which number over 100,000, are unique tools made by users who share them with others, making the platform home to a substantial and diverse collection of trading scripts.

The community gains from this shared knowledge, thanks to the programmers who contribute their scripts, reflecting TradingView’s commitment to collaboration.

Watchlist

TradingView also offers watchlists, an essential feature for traders who need to monitor the financial instruments they are interested in quickly. These lists offer real-time updates, and the platform’s design allows users to easily organize multiple watchlists that cater to diverse strategies or market segments.

Customization is key here; you can tweak details like ticker symbols, price ranges, and percentage changes to align with your trading preferences. Moreover, personalized alerts ensure you’re notified of market movements as they happen, helping you act swiftly and decisively.

Sharing these watchlists within the platform’s community is also possible, encouraging the exchange of ideas and collective learning.

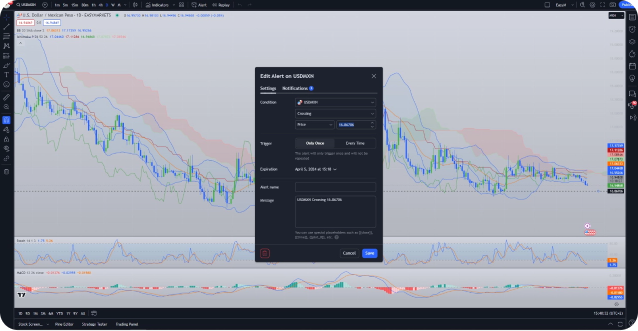

Alerts

Among other key features, TradingView’s comprehensive alert system also stands out as a customizable tool that traders can fine-tune to stay informed about the performance of various financial instruments in real-time. The in-depth alert system allows traders to tailor the tool to their needs, tracking any financial instrument as events unfold. Traders can create alerts for exact price points, technical analysis insights, or periodic reminders. Notifications are delivered via the website, email, or mobile push notifications, meaning traders can stay informed about market moves without having to keep their eyes glued to the screen all day.

The platform goes a step further by incorporating variables from its own Pine Script studies or those crafted by users into these alerts, expanding their versatility. With this real-time, customizable alert capability, traders can significantly upgrade the effectiveness and efficiency of their trading approach.

Headlines

In addition to its flexible alert system, TradingView ensures traders remain well-informed with headlines that provide instant updates and valuable insights on pivotal market trends and global economic developments. Its headlines deliver real-time updates and insights into crucial market trends, presenting traders with the latest news and keeping traders in the loop about global economic shifts. They delve into different trading approaches, technical analysis, pricing patterns, chart indicators, and other critical factors that support investment decisions.

Additionally, the platform’s headlines provide guidance on the impact of geopolitical events on market behavior and simplify complex economic data and financial reports for the trading community, expanding their understanding. With input from industry experts, these headlines can significantly influence trading outlooks and offer valuable advice for tackling the fast-paced and unpredictable trading environment.

Economic Calendar

Following the insightful headlines, TradingView further supports traders with its Economic Calendar, a feature loaded with up-to-the-minute trading information on significant worldwide economic events. The platform’s Economic Calendar offers a wealth of real-time trading information on global economic events. It covers important details like macroeconomic news, official statements, and predictions alongside the results once released. These pieces of trading information are key drivers in the financial markets.

Users can sort the events based on the country, significance, and type, making finding the data most relevant to their needs easier. Moreover, the Economic Calendar can be seamlessly combined with the charting tools on TradingView, allowing traders to monitor how economic events affect market trends. Grasping this tool is crucial for crafting a solid trading strategy. It is an integral part of thorough market analysis.

Other TradingView Features

Understanding these tools is just the beginning; there are even more features to explore with an easyMarkets account on TradingView - the features we’ve touched on are simply a glimpse into the platform’s capabilities. By connecting your easyMarkets account, you tap into easyMarkets’ steadfast guarantees like no slippage on limit orders, consistently tight fixed spreads, negative balance protection, and no hidden fees. These conditions combine perfectly with TradingView’s market insights, advanced charting, and social community features. This potent combination can help transform the way you trade, strategize, and understand market dynamics. Experience the benefits for yourself by trying out easyMarkets on TradingView right away!

easyMarkets Account on TradingView allows you to combine easyMarkets industry-leading conditions, regulated trading, and tight fixed spreads with TradingView’s powerful social network for traders, advanced charting, and analytics. Access no slippage on limit orders, tight fixed spreads, negative balance protection, no hidden fees or commission, and seamless integration.

Why Should You Get Started Today?

With the power to elevate your trading journey, why not start experiencing the advantages of an easyMarkets account on TradingView today? Both novice and seasoned traders can find real value in it. Regardless of your focus area—stocks, cryptocurrencies, forex, futures, or indices—you’ll have access to the latest data, insightful market analyses, and robust trading features.

The trading platform is particularly user-friendly, a boon for beginners learning the trading ropes. At the same time, it boasts advanced functionalities that seasoned traders, investment firms, financial consultants, and brokers can leverage to refine their strategies and decision-making processes. Additionally, the trading platform benefits financial educators, giving them cutting-edge tools to teach trading principles effectively.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an “as-is” basis, are intended only to be informative, are not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. easyMarkets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third-party.

How to get started?

Trading on TradingView is a straightforward process. Begin by selecting a broker from their roster of supported options. Once you’ve registered with your chosen broker and deposited funds into your account, navigate to the TradingView chart interface. Locate the “Trading Panel” at the bottom, select your broker, and sign in with your credentials. After these simple steps, you’ll be ready to trade across various assets.

Linking your easyMarkets account to TradingView is easy.

1. Start by logging into your TradingView account or sign up for one on the website by providing the required details.

2. Find the “Trading Panel” below the charts. Here, you’ll see a range of trading platforms available for linkage to your TradingView account.

3. Find easyMarkets in the list and click on it to begin the integration.

4. Before proceeding, ensure you’ve got an active easyMarkets account ready. Use your easyMarkets login credentials during the next step.

5. When selecting easyMarkets, you’ll be prompted to enter your login details. Enter your username and password.

6. Hit “connect,” and your easyMarkets account will successfully connect with TradingView. To confirm, your easyMarkets account will be listed in the “Trading Panel,” you’ll be all set to trade directly through the program’s interface.

Having successfully linked your easyMarkets account and seeing it appear in the “Trading Panel,” you’re now ready to engage with the markets on TradingView.

Conclusion

TradingView is a comprehensive financial trading platform that caters to traders of all experience levels. It has extensive charting capabilities, up-to-date market insights, and public and private knowledge-sharing channels. The platform is designed with users in mind, offering an intuitive experience that streamlines trading activities. You can even integrate your preferred broker, such as easyMarkets, directly with TradingView, unlocking the platform’s full functionality and allowing for smooth trading transactions. Available to both free and premium users, TradingView offers everyone a window into the world’s financial markets.

At its core, TradingView is more than a platform —it’s a vibrant hub where traders can broaden their understanding of the markets and refine their approach to trading.

TradingView is a robust trading platform that has revolutionised the online trading and investment landscape. In this article, we’re going to take a closer look at what the platform is all about, how it works, and the various advantages it offers to traders and investors across the globe. It doesn’t matter if you’re an experienced trader or a newcomer to financial markets; getting to grips with this platform could improve your approach to trading, deepen your understanding of the markets, and possibly lead to greater success. Stay with us as we dive into the details of this versatile platform.

Table of Contents

Frequently Asked Questions

Yes, you can. The platform allows for direct broker integrations. For instance, you can integrate with a broker like easyMarkets and trade from the platform. This helps leverage its full potential for a seamless trading experience.

The platform offers both free and premium subscription plans. While the free version supplies access to basic features, the premium subscriptions provide enhanced services such as more indicators per chart, ads-free usage, and priority customer service.

Absolutely. TradingView is a trading and charting platform and a social community where users can share their trading charts, strategies, and ideas publicly or privately. This allows for collaborative idea exchange, enhancing trading experiences and financial knowledge.